The U.S. economy has continued to create jobs. The establishment report, which measures jobs at known entities, added 431,000 new jobs last month. Economists expected 478,000 new jobs. The previous two months were revised higher by nearly 100,000, making up for the slight miss. Unemployment dipped to 3.6%, according to the household survey, which includes self-employed workers. The household survey indicated the labor force grew to 164.4 million, supporting the idea people are returning to the labor force.

Key Points for the Week

- The U.S. created 431,000 jobs last month, and unemployment dipped to 3.6%, signaling the economy remains strong.

- The S&P 500 fell 4.6% last quarter. It has been the only negative quarter in the last two years.

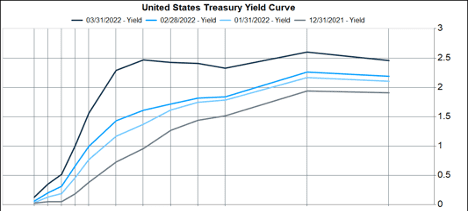

- More of the yield curve inverted as the yields on bonds maturing in two, three, five, and seven years moved above 10-year yields.

Concerns about rates rising quickly in response to inflation have inverted parts of the yield curve. The 10-year yield is now higher than yields from two-year to seven-year bonds. The expanded yield curve ignited discussion regarding whether the move signals a recession is likely. We believe inverted yield curves are more likely to indicate the economy will slow rather than cause a recession to occur.

The S&P 500 posted its first negative quarter in two years. The index of large U.S. companies slipped 4.6% last quarter. Global stocks declined 5.4% as the response to Russia’s invasion of Ukraine is likely to affect European countries more than the U.S. The Bloomberg U.S. Aggregate Bond Index fell 5.9%. Higher rates and ongoing inflation pushed bond yields higher (Figure 1).

The stock market losses would have been worse if not for the last month. The S&P 500 climbed 3.7% in March, and the MSCI ACWI added 2.2%. The Bloomberg U.S. Aggregate Bond Index fell 2.8%. Last week, the S&P 500 added just 0.1%, the MSCI ACWI gained 0.5%, and the Bloomberg U.S. Aggregate Bond Index soared 0.8%. There are no major data releases scheduled for this week.

Figure 1 – Source FactSet Research Systems

The Jobs Market Keeps Growing

“If you want a job in the United States, you can get one and probably get multiple jobs at this point. If you’re an employer looking for workers, it’s hard to both hire them and retain them.”

— Mary Daly, president of the San Francisco Federal Reserve Branch.

Daly’s succinct summary of the jobs market was strongly supported by a bevy of jobs data released last week. The establishment survey reflected continued rapid job growth. The economy created 431,000 jobs last month. People working hard to be pessimistic could point out that the number missed expectations of 478,000 and was the slowest growth in the last six months. Both statements are true but do not overcome the core conclusion that job creation remains strong.

The household survey indicated unemployment fell to 3.6% even though the labor force grew by 418,000. Higher wages and falling COVID risks have combined with less generous unemployment benefits to push people back to work. The decline in unemployment means more jobs are being created than new people are entering the labor force.

As Daly noted, retaining workers remains a challenge. Average hourly earnings increased 0.4%. Wage pressures suggest inflation is becoming more deeply imbedded in the U.S. economy. Employees are also quitting their jobs at a rapid rate. More than 4.25 million people are estimated to have quit their jobs in February. Workers are hard to retain because short-staffed employers are raising pay and luring workers away. Daly’s comments about jobs being plentiful align with estimates of a near record 11.3 million jobs available to people qualified to fill them.

All this job growth is fueling expectations inflationary pressures will remain strong. The PCE inflation index rose 0.6% last month, and core inflation, which excludes food and energy, rose 0.4%. The big driver of inflation is the price of goods, which rose 1.1% in February. Services inflation climbed 0.4%, which is still fast but much closer to the Fed’s stated goal of just less than 0.2% each month.

The strength of the recovery is causing many to reassess their interest rate expectations. President Daly suggested the case for a 0.5% hike next month is strengthening. One month ago, most investors expected a pair of 0.25% increases at the May and June meetings. Base expectations are rates will now increase 0.5% each meeting.

The expectation for a faster increase in rates has pushed short- and intermediate-term rates higher, creating an inverted yield curve. What has been interesting is long-term rates aren’t moving higher as quickly as short-term rates. This interest rate trend reflects an expectation the Fed will raise rates quickly and perhaps too far and then reverse that decision as inflation fades and the economy doesn’t grow fast enough to match the supply of labor joining the workforce.

The news media loves to talk about inverted yield curves and frequently cites various indicators successfully forecasting the last nine or more recessions. Like some baseball records, that effectiveness deserves an asterisk. When the yield curve inverted in 2019, the Fed responded with three quick rate decreases and the economy continued to strengthen with acceptable inflation. A recession caused by tight rates was improbable. The recession only came about because of COVID and policy responses to try contain the spread.

Based on the comments from President Daly and others, we expect a 0.5% increase the next two months. Our preference would be for rate increases to slow after rates are above 1% and only increase by 0.25% every other meeting. Instead, the Fed should consider shrinking its balance sheet more at an accelerated pace in an effort to slow the economy and allow long-term rates to rise and stay above short-term rates.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

https://halearon.com/feds-daly-says-case-for-half-point-rate-rise-in-may-has-grown/

https://www.federalreserve.gov/monetarypolicy/openmarket.htm

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.bls.gov/news.release/jolts.nr0.htm

Compliance Case # 01324804