Market volatility continues to make life challenging for investors. The S&P 500 declined for the sixth straight week, the longest streak since 2011. Six-week losing streaks used to be much more common. The S&P 500 declined at least six consecutive weeks six different times from 2000 to 2011.

Key Points for the Week

- The S&P 500 declined for the sixth straight week.

- Consumer prices rose 0.3% last month. The annual inflation rate declined for the first time since 2021.

- Approximately 85% of S&P 500 companies have cited inflation as a factor on earnings calls.

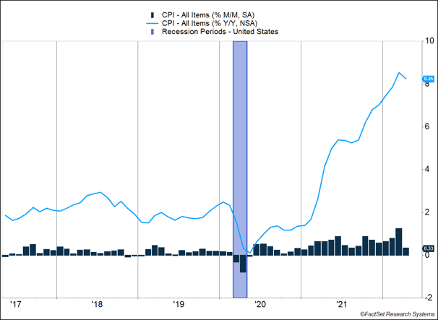

The string of accelerating inflation was broken. The Consumer Price Index (CPI) increased 0.3% last month and has now risen 8.3% over the last 12 months. The 0.3% was a slowdown from recent data, and the annual rate declined 0.2% in the last month (Figure 1). Much of the slowing was attributed to gasoline prices, which fell but have since rebounded to record highs. Core inflation, which excludes food and energy, rose 0.6% as high rents and costlier airfares contributed to strong gains in inflation.

Inflation has been a hot topic on corporate earnings calls. Approximately 85% of S&P 500 companies have mentioned inflation on their quarterly calls with shareholders. S&P 500 earnings are expected to grow 9.1%. Companies are beating earnings by less than normal. With more than 90% of companies reporting, earnings are beating estimates by 4.9%, compared to a recent average of 8.9%. Consumer discretionary and communication services companies are missing earnings estimates most frequently, and those two sectors have underperformed the broader markets.

Last week, the S&P 500 sank 2.4% and narrowly missed breaking through the 20% threshold before rallying on Friday. The global MSCI ACWI declined 2.2%. The Bloomberg U.S. Aggregate Bond Index rallied 0.9%. U.S. retail sales data will be released this week and will indicate how consumers are responding to higher inflation.

Figure 1

Narrowly Missed a Bear Market

The S&P 500 narrowly missed a bear market on Thursday. The index of large-cap stocks finished 18.1% below its closing high on Jan. 3, 2022. At one point Thursday morning, the S&P 500 was 19.6% below its closing high before rallying on Thursday afternoon and then staging a strong rally on Friday.

The volatility would likely be easier to bear if it hadn’t been going on for a while. Last week’s decline was the sixth straight weekly decline. As noted above, the S&P 500 hasn’t had a six-week losing streak since 2011. However, the previous 11 years included six losing streaks of six weeks or longer. The longest streak occurred in 2001, when the S&P 500 declined eight consecutive weeks. The Federal Reserve was part of the issue then as well. Markets had expected a 0.75% cut in rates and the Fed cut rates just 0.5%.

There was some good news on inflation. Core CPI rose only 0.3%, which is the lowest increase since August 2021 (Figure 1). Even though monthly inflation dropped, monthly increases of 0.3% still translate into inflation between 3% and 4%, above the Fed’s target of 2%.

It is possible inflation may have reached a peak. It started accelerating in September 2021, meaning future reports will need fairly high readings to keep inflation at current levels. The Fed’s recent interest rate hikes have already made certain types of borrowing less attractive, reducing demand. Other factors are also pushing against inflation. The stock market decline means some people may not have as much money to spend or feel as confident about spending what they have. Government spending has slowed compared to extreme spending in response to COVID-19. The increased strength in the dollar is helping to reduce the cost of imports.

Energy prices remain the biggest risk to the thesis that inflation will start declining. Last month, gasoline prices dropped 6.1%, and that decline contributed to lower overall gains. Gasoline prices have subsequently rebounded to new highs, and core inflation, which excludes food and energy, remains strong. The core rate increased 0.6% in April. So, it is possible inflation may have peaked or is close to doing so, but that doesn’t change the fact that inflation pressures remain high.

As we noted in a special market update last week, some of the trends pressuring markets may be at inflection points. Inflation may be peaking, and employment has nearly recovered all of its COVID-led losses. The Fed has committed to moving toward a more normalized interest rate environment, and we are working through the second year of a presidency, which typically produces the weakest performance of the election cycle.

Challenges like this one are not new. Staying focused on your long-term goals during difficult times is an important part of harnessing the long-term gains in equity markets. While the rapid increase of inflation has been tough, so were periods like the 1987 market crash, the bursting of the dotcom bubble, and the global financial crisis. Yet, markets worked through those periods and moved on to new highs.

In fact, the longer you stay invested the less decisions matter about what types of stocks you invest in. In the short term, value stocks have been rebounding after a long period in which growth outperformed. Over the long term, sticking with stocks, regardless of style, makes a big difference. In the last 10 years, the S&P 500 has increased 13.7% per year. Large-cap value and growth stocks have both increased more than 10% per year over this period. Global stocks, represented by the MSCI ACWI, have climbed 9.2% per year. Bonds have generated positive returns. This performance didn’t come in periods of pure calm with a perfect economy. Inflation has been too low and too high. Both parties have held the presidency. We’ve faced a global pandemic and its aftereffects. In spite of all these challenges, markets have climbed higher.

There is no guarantee it will work out well this time, but we like our odds.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://dashboard.carsongroup.com/research/weekly-commentary/05-13-22-special-market-commentary/

https://money.cnn.com/2001/03/20/markets/markets_newyork/

https://www.barrons.com/articles/stock-bear-market-history-51652488484

https://www.foxbusiness.com/markets/national-average-gas-prices-new-record-high-445-per-gallon

https://www.bonus.com/election/midterms/

https://www.bls.gov/news.release/cpi.nr0.htm

Compliance Case #01372051